Validating a business idea in the United States has never been more important, especially in 2025 where competition across industries is fierce and new ventures are constantly emerging. Entrepreneurs who want to succeed must go beyond simply having a great concept and focus on confirming that their idea has genuine demand, strong market potential, and long term sustainability. Validation is the foundation that ensures time, money, and resources are invested in the right direction.

This guide on the top ten ways to validate your business idea in USA 2025 explores practical strategies backed by real market insights. It covers essential approaches like conducting detailed market research, analyzing competitors, testing product market fit, and gathering customer feedback to ensure your offering solves an actual problem. Other proven methods such as creating a minimum viable product, leveraging online surveys, testing advertising campaigns, and studying emerging industry trends help entrepreneurs understand whether their business can thrive in the current American economy.

With topics such as startup funding, lean business models, small business trends in USA 2025, and consumer behavior shifts, this article gives business owners the right tools to reduce risks and increase chances of growth. Whether you are launching a tech startup, retail brand, or service based company, these validation techniques provide clarity and direction for building a business that truly works.

Top Ten Ways To Validate Your Business Idea In USA (2025)

10. Trend tracking and demand signals with Google Trends and listening tools

Modern idea validation begins with listening. Tracking what people search for and what topics are rising in interest reveals where attention and demand are moving. Using Google Trends together with social listening and marketplace data helps distinguish seasonal interest from steady growth. For example, comparing related search terms shows which wordings and benefits resonate, which in turn informs headlines, ad copy and product descriptions. Triangulating search volume with marketplace listings and early seller activity reduces the chance of mistaking a viral moment for lasting demand.

Trend tools also highlight geographic pockets of interest which can guide launch cities, influencer outreach and paid media targeting. When combined with keyword research, these insights feed a content plan that ranks faster because it uses the same language potential customers type when they look for solutions. This phase does not prove purchase intent but it does point to where curiosity exists. Treat trend tracking as an early filter. If multiple data sources show rising queries and product searches, the idea is worth deeper testing.

9. Turn assumptions into testable hypotheses and prioritize them

A winning validation process starts by writing down specific assumptions about customers, pain points and willingness to pay. Each assumption should be framed as a testable hypothesis such as people with problem X will spend Y to get solution Z. Once recorded, rank assumptions by risk and by how much they would kill the idea if wrong. This makes it possible to focus scarce effort on the riskiest unknowns first. For instance if channel fit is uncertain, run a traffic test before building features. If price sensitivity is unknown, test multiple price points with a small paid campaign.

Designing experiments around single assumptions avoids noisy results. Track measurable outcomes such as sign up rate conversion rate or click through rate and treat unexpected findings as learning not failure. Use short experiments that deliver clear pass or fail signals, and always capture the language respondents use to describe their problems. That language later becomes the backbone of product copy and search friendly content. Framing and prioritizing hypotheses keeps validation tactical and efficient while preserving the option to pivot quickly.

8. Customer interviews and deep discovery to uncover real demand

Conversations with potential customers are unmatched for revealing true motivations. Well planned interviews focus on current behaviour and past attempts to solve the problem rather than asking people whether they would buy an imaginary product. Use open ended questions and ask for detailed examples about recent decisions, costs and workarounds. Probe into the emotional and financial friction associated with the problem. A pattern of similar stories across multiple interviews is strong evidence of an unmet need. Keep interview notes verbatim whenever possible because phrases used by interviewees feed headline testing and SEO friendly page copy.

When sample size grows and the same language and pain points repeat, those patterns validate both the problem definition and early positioning. Tap networks and trade communities to find interviewees across different segments and levels of decision making. Structured customer discovery is low cost and high impact when done with discipline. It surfaces features that matter, pricing clues and believable early adopter profiles that can be targeted with content and ads.

7. Low cost surveys and quantitative polling to measure interest

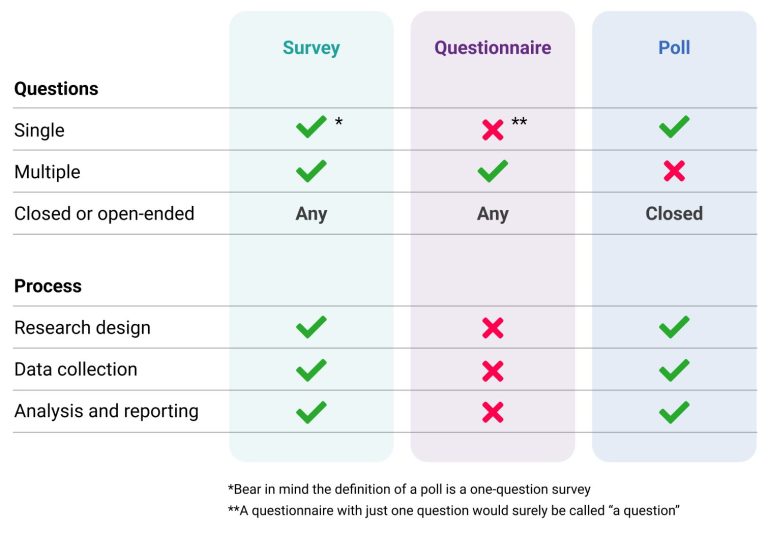

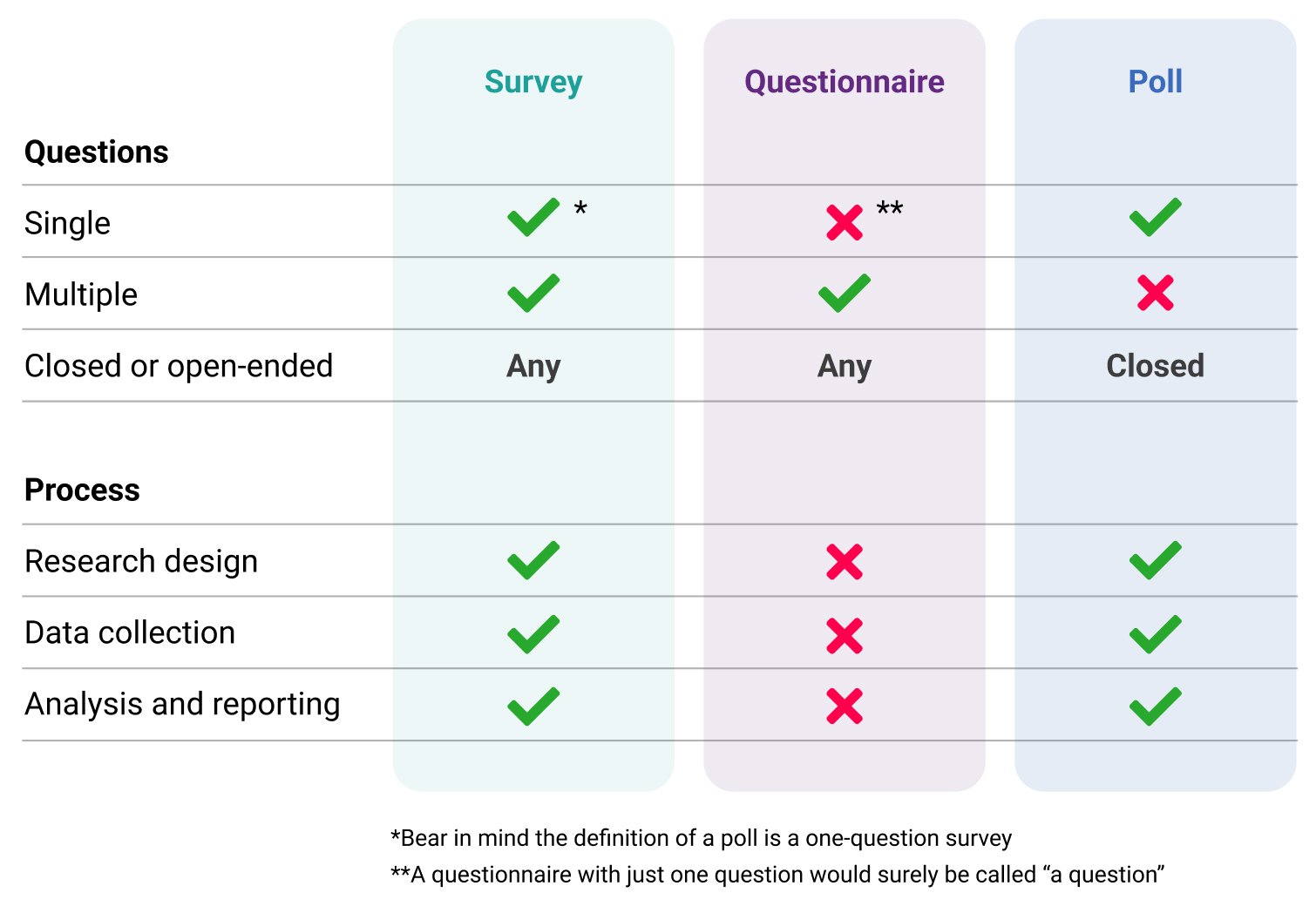

After qualitative work, simple surveys provide scale. Short structured surveys measure how common a problem is and how urgent it feels. Keep surveys concise and anchor some questions to real trade offs like willingness to give up time or money. Include a single open ended question to collect the language respondents use. Share surveys in targeted communities such as subreddits industry forums or niche social groups to reach likely customers rather than a random audience. Analyze results for signposts like repeatable objections and common feature requests.

Use net promoter score style questions to gauge enthusiasm and intent. If a high share of respondents indicate strong interest or willingness to pay then the business case strengthens. Use modern survey tools to collect responses cleanly and to export data for segmentation. Survey results work best when combined with other signals such as interview patterns and landing page conversion rates so that noisy samples do not mislead the decision to invest. Good survey design and careful audience selection make this a reliable next step.

6. Launch a landing page or waitlist and measure real demand

A single focused page that explains the solution and invites people to sign up can convert curiosity into measurable interest. Landing pages are effective because they expose whether the messaging resonates and whether the primary value proposition motivates action. Include a clear value headline concise benefit bullets social proof if available and a single call to action such as join the waitlist or preorder. Run a small paid test or earn organic visits through targeted content and social posts. Track metrics such as click through conversion rate and cost per sign up.

A strong conversion rate at reasonable ad cost signals product market fit potential and helps refine the most effective wording and channel. Use A B testing to compare headlines or calls to action and iterate quickly. Waitlist sign ups are tangible commitments that can be used to refine early production estimates, to seed a launch email sequence and to recruit beta testers. A simple landing page is one of the fastest ways to move from idea to validated demand because it forces the market to vote with an action rather than a survey response.

5. Use preorder offers and crowdfunding to test willingness to pay

Monetary commitment is the clearest validation. Preorder campaigns and crowdfunding pages separate passive interest from actual purchase intent because people back a product with money. Construct a campaign that transparently describes what buyers will receive and when. Offer early bird perks or limited edition versions to incentivize early adoption but keep promises realistic. Success on a crowdfunding platform or a direct preorder funnel proves that the offering resonates and that the value is sufficient to overcome purchase friction. The campaign also provides visibility into which reward tiers perform best and which messages convert browsers into buyers.

Use campaign analytics to understand geographic concentration repeat purchases and referral drivers. Even modest preorder volume can validate production assumptions and unlock funds for initial manufacturing or development. Preparation matters: a strong pre campaign audience and clear storytelling are often the difference between modest traction and meaningful validation. Crowdfunding is not only a financing tool but also a real time market test.

4. Build a minimum viable product and learn fast

A minimum viable product is a functional but simplified version of the offering built to test core value proposition and user behaviour. The goal is not perfection but learning. Launching an MVP enables direct observation of how users engage, which features are used and where they drop off. Use analytics to capture key events and instrument funnels that answer the most important questions. Early adopter feedback will expose product design improvements and priority features. Iterate quickly and release updates that address real usage problems rather than guesswork.

This build measure learn cycle reduces wasted effort and focuses investment on what moves key metrics. Keep the scope narrow and measure outcomes that map to long term viability such as retention conversion and referrals. An effective MVP saves capital while delivering high signal about market fit. Document the lessons from each iteration and let that learning guide roadmap and marketing choices. The lean approach turns uncertainty into evidence and enables clearer go no go decisions.

3. Competitor analysis and market gap mapping

A careful review of the competitive landscape shows which problems are already being solved and how well existing solutions perform. Search for direct and indirect competitors and assess their strengths, weaknesses and customer feedback. Study product features pricing models distribution channels and marketing messages. Pay special attention to gaps such as underserved segments slow customer support or missing integrations that create frustration for users. Competitor advertising and job postings reveal strategic focus and potential market investment.Where competitors spend heavily on ads there is often proven demand but also greater customer acquisition cost.

Mapping gaps lets positioning stand out in search results and in content. Differentiation is less about inventing an unthinkable product and more about resolving real friction points in a way that matters to a target segment. Combine on the ground research with digital tools to estimate traffic demand and to identify channels that competitors are effectively using. This analysis informs pricing choices product bundles and marketing hooks that resonate and rank

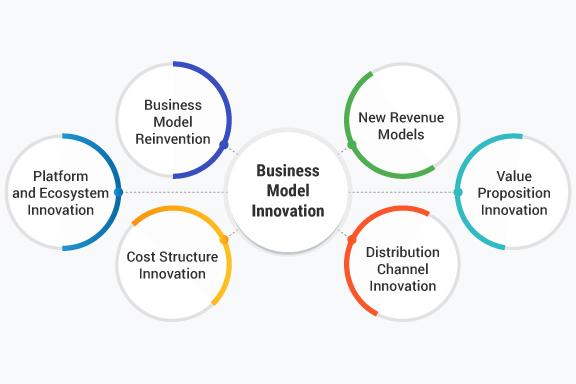

2. Use structured frameworks to clarify the business model and market opportunity

Frameworks such as the Business Model Canvas and the Market Opportunity Navigator bring clarity to assumptions about value creation customer segments channels cost structure and revenue streams. Mapping the idea on a canvas forces difficult questions to the surface and reveals interdependencies that might otherwise be missed. The Market Opportunity Navigator helps identify multiple market paths that can be tested in parallel and it supports selecting the most attractive initial focus given resources and capabilities.These tools encourage systematic experiments, for example testing different customer segments with small pilots or trial offers.

Documenting hypotheses in a structured framework also makes it easier to communicate the logic to advisors early customers and potential investors. Use the canvas to define the smallest set of features needed to serve a core segment and then design tests that either validate or invalidate the assumptions with measurable outcomes. Frameworks are not academic exercises when they become the operating map for rapid testing and decision making.

1. Iterate based on real feedback until product market fit becomes evident

The most powerful validation is iterative learning. Feed results from interviews surveys landing pages preorders and MVP usage back into product and marketing decisions. Prioritize changes that move key metrics such as activation retention conversion and referrals. When the same small set of features keeps delivering engagement across segments and retention rates rise, product market fit is becoming tangible. Keep experimenting with pricing channels and messaging to find the most efficient acquisition paths. If iterations repeatedly fail to improve core metrics, that is also a valid outcome that conserves resources and allows graceful exit or pivot.

Document each test with clear hypotheses metrics and conclusions so decisions are traceable. Over time, validated learning reduces uncertainty and shapes a scalable go to market plan that drives sustainable growth. The final evidence of fit is repeatable customer acquisition at acceptable cost and observable organic growth prompted by satisfied customers recommending the product to others.