Rich people as well as those who want to be financially consistent over the long haul need smart investments. “The Top Ten Rules For Smart Investing” analyses basic ideas that let investors make intelligent, well-informed decisions in their own best interests in the complex environment of finance. This wide-ranging book examines techniques shown to increase revenues while lowering risk. The content in this book will appeal to both experienced and new investors. Diversification, risk control, and market trend analysis rank among the most important factors influencing the design of a well-balanced investment portfolio.

It underlines specifically the significance of precisely identifying financial goals, completing thorough research, and keeping discipline even in doubtful economic circumstances. Focussing on asset allocation helps investors lower their risk by spreading their money throughout different types of assets—stocks, bonds, real estate. This book teaches how to use compound interest to get wealthy, maintain current on the most recent economic trends, make decisions free from letting emotions to guide you. By stressing long-term planning, patience, and the ability for change, which follow these rules encourages people to have the confidence to traverse the financial markets free-will. Those who want to be successful in investing and grasp more about money can benefit from the knowledge in this article. By means of wise investing strategies, these concepts can help to assure a positive future, control risks, and enhance portfolios.

The Top Ten Rules For Smart Investing

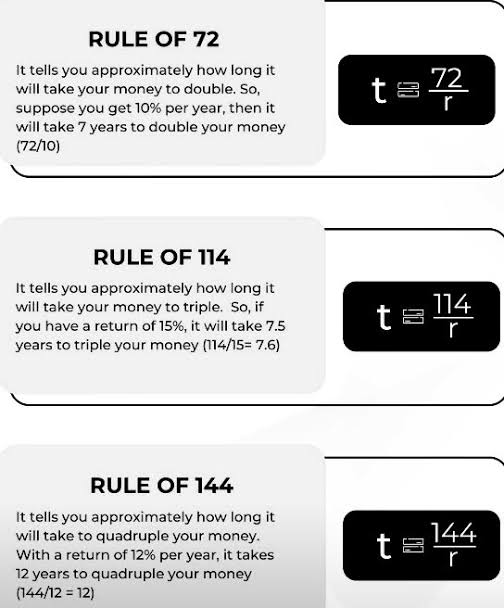

10. Net Worth Rule

Description

The Net Worth Rule provides a benchmark for assessing financial health, suggesting that net worth (total assets minus liabilities) should ideally equal (Age × Gross Annual Income) ÷ 10 for global applicability. This metric tracks progress in wealth accumulation, encouraging disciplined saving and strategic investing. Assets like stocks, real estate, or savings contribute to net worth, while liabilities such as loans or credit card debt reduce it. Regularly evaluating net worth helps investors identify gaps, adjust financial plans, and prioritize long-term goals like retirement or financial freedom. This rule promotes accountability, ensuring investments align with wealth-building objectives and fostering a proactive approach to financial security.

Example

A 30-year-old with an annual income of $60,000 should aim for a net worth of $180,000 (30 × 60,000 ÷ 10). If their assets (e.g., $150,000 in investments and $50,000 in savings) total $200,000 and liabilities (e.g., $30,000 in loans) subtract, their net worth is $170,000, slightly below the target, signaling a need to boost savings or reduce debt.

Application Tip

Calculate net worth yearly by listing assets (e.g., investments, property) and subtracting liabilities (e.g., mortgages). If below the benchmark, increase contributions to high-return assets like equities or pay down high-interest debt to align with goals.

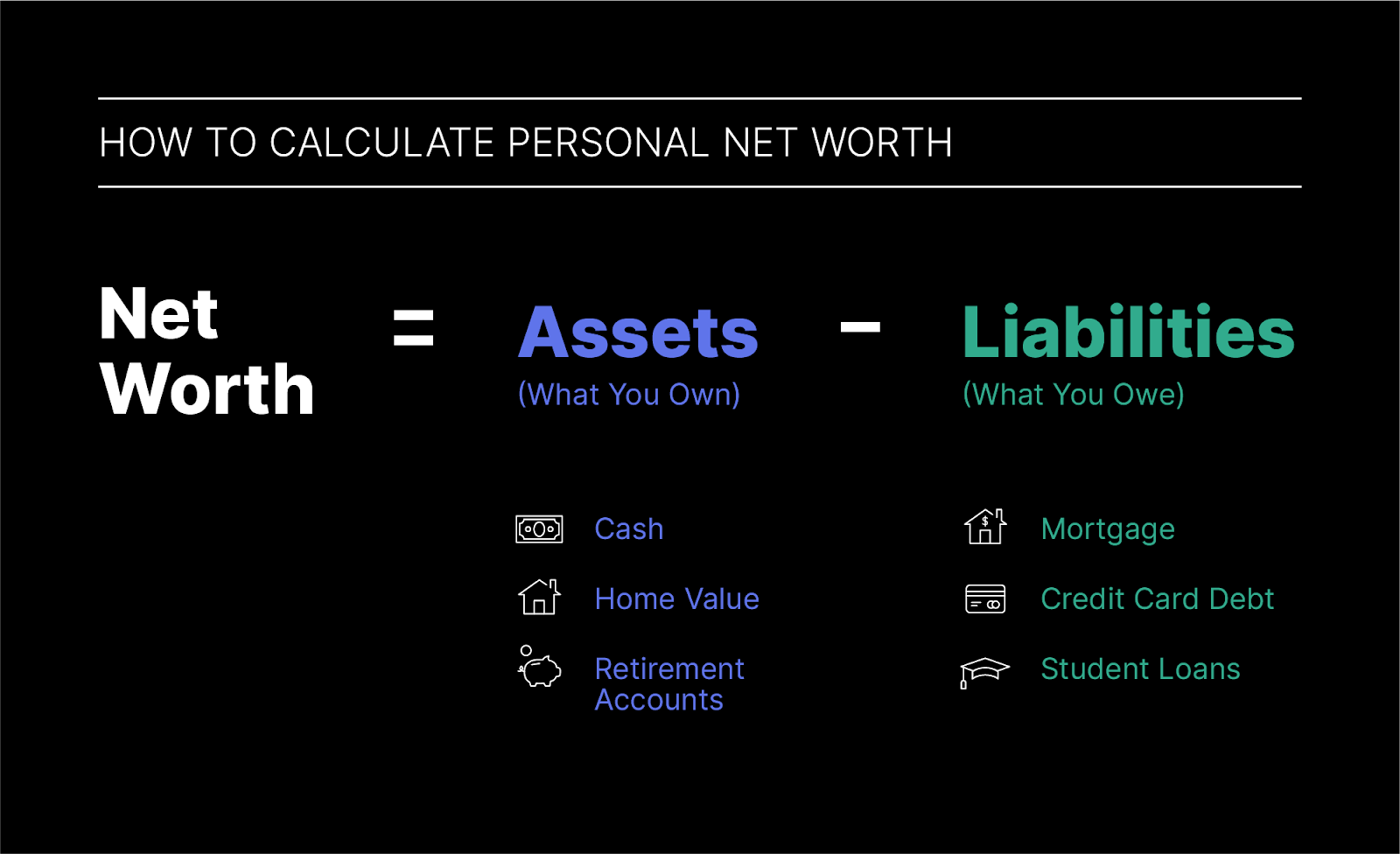

9. 4% Withdrawal Rule

Description

The 4% Withdrawal Rule is a cornerstone for sustainable retirement income, advising retirees to withdraw no more than 4% of their investment portfolio in the first year, adjusting annually for inflation. This approach ensures funds last at least 30 years, balancing income needs with portfolio longevity. Ideal for diversified portfolios with stocks and bonds, it mitigates risks from market downturns and rising costs. By adhering to this rule, retirees can maintain financial security, avoid depleting savings prematurely, and enjoy a stable lifestyle. It emphasizes disciplined spending and strategic asset allocation, making it a vital tool for long-term wealth preservation and financial independence.

Example

With a $1 million retirement portfolio, withdraw $40,000 in the first year (4%), or about $3,333 monthly. If inflation is 3% the next year, adjust to $41,200 ($40,000 × 1.03). A portfolio yielding 6-7% annually, split between equities and bonds, supports this strategy, ensuring funds last through retirement.

Application Tip

Review your portfolio annually to confirm it supports a 4% withdrawal rate. Diversify across stocks, bonds, and inflation-linked assets to maintain purchasing power and ensure long-term sustainability.

8. 10% for Retirement Rule

Description

Saving for retirement is essential for financial independence, and the 10% for Retirement Rule recommends allocating at least 10% of annual income to retirement savings, increasing contributions by 10% yearly. This leverages compound interest, allowing consistent investments to grow significantly over time. Starting early maximizes growth, building a robust retirement corpus. The rule is flexible, fitting various income levels, and works well with tax-advantaged accounts like 401(k)s or IRAs. It encourages proactive planning, helping investors avoid financial strain in later years and achieve long-term wealth-building goals through disciplined, incremental savings.

Example

A 25-year-old earning $50,000 saves $5,000 annually (10%) in a mutual fund with a 10% return. By age 60, this could grow to approximately $2.4 million. Increasing contributions by 10% yearly (e.g., $5,500 in year two) further accelerates growth, showcasing the power of compounding.

Application Tip

Automate retirement contributions to ensure consistency. Use tax-advantaged accounts and incrementally increase savings as income rises to maximize compounding and build a substantial retirement fund.

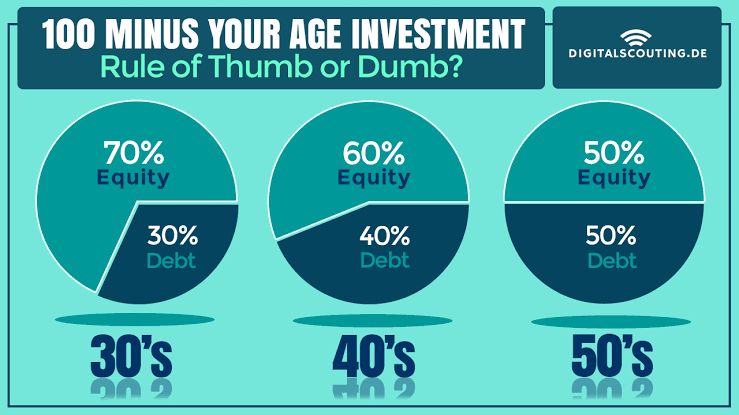

7. 100 Minus Age Rule

Description

The 100 Minus Age Rule is a straightforward asset allocation strategy, recommending that the percentage of your portfolio in equities equals 100 minus your age, with the rest in bonds or fixed-income assets. This balances growth and stability, as younger investors can handle higher equity exposure for returns, while older investors shift to safer assets to preserve capital. The rule adapts to changing risk tolerance over time, aligning investments with life stages and financial objectives. It simplifies portfolio construction, making it accessible for building a diversified, risk-managed investment strategy that supports long-term financial planning.

Example

At age 25, allocate 75% of a $10,000 portfolio ($7,500) to equities and 25% ($2,500) to bonds. By age 35, shift to 65% equities ($6,500) and 35% bonds ($3,500), reducing risk as retirement approaches, balancing growth and capital preservation.

Application Tip

Rebalance your portfolio annually to maintain the suggested allocation. Adjust based on risk tolerance and goals, ensuring a mix of stocks, bonds, and other assets to optimize returns and manage volatility.

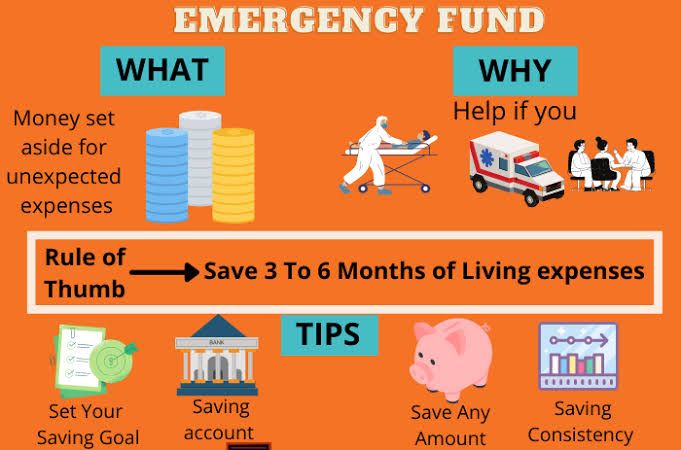

6. Emergency Fund Rule

Description

An emergency fund is a critical buffer for financial security, and this rule advises maintaining 6 to 12 months of living expenses in liquid assets like savings accounts or money market funds. This ensures quick access to funds during unexpected events, such as job loss or medical emergencies, without disrupting long-term investments. By avoiding the need to sell assets during market downturns, investors protect their wealth-building strategy. The rule emphasizes liquidity and stability, promoting disciplined saving and peace of mind while pursuing financial goals, making it a foundational step in effective financial planning.

Example

If monthly expenses are $3,000, an emergency fund should range from $18,000 (6 months) to $36,000 (12 months). Placing this in a money market fund yielding 3-4% provides modest returns while ensuring accessibility for emergencies like unexpected repairs or unemployment.

Application Tip

Create a dedicated account for your emergency fund and automate contributions. Choose low-risk, liquid investments to preserve capital and ensure funds are readily available when needed.

5. 10,5,3 Rule

Description

The 10,5,3 Rule sets realistic return expectations for asset classes: 10% annually from equities, 5% from bonds or debt instruments, and 3% from savings accounts or fixed deposits. This guideline helps investors construct a balanced portfolio, combining growth-oriented assets with stable ones to manage risk. Equities drive higher returns but carry volatility, while bonds and savings offer security. The rule simplifies asset allocation, enabling investors to align their portfolios with risk tolerance and financial goals, fostering sustainable wealth-building strategies that are accessible to beginners and seasoned investors alike.

Example

For a $100,000 portfolio, allocate 50% ($50,000) to equities targeting 10% returns, 30% ($30,000) to bonds at 5%, and 20% ($20,000) to savings at 3%. This mix yields a blended return of about 7%, balancing growth and stability.

Application Tip

Use this rule as a baseline for portfolio allocation. Monitor market trends and adjust percentages based on risk appetite and investment horizon to optimize returns while managing risk.

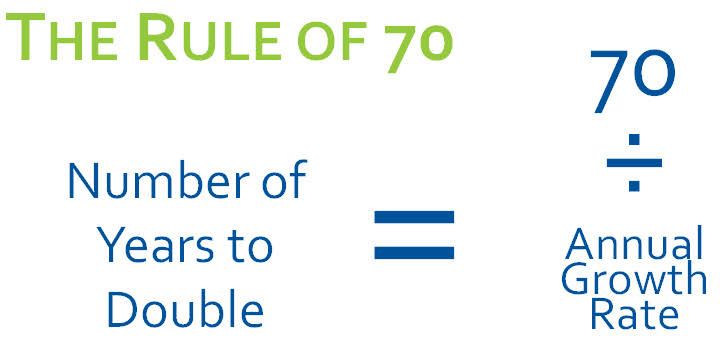

4. Rule of 70

Description

The Rule of 70 highlights inflation’s impact on purchasing power, calculating how long it takes for money’s value to halve by dividing 70 by the annual inflation rate. This rule underscores the need to invest in assets that outpace inflation, such as stocks or inflation-linked bonds, to preserve wealth. It encourages proactive financial planning, ensuring returns exceed rising costs to maintain real value. By integrating inflation awareness into investment decisions, the rule supports long-term financial security, helping investors build portfolios that withstand economic pressures and sustain wealth-building efforts over time.

Example

At a 4% inflation rate, $50,000 will have the purchasing power of $25,000 in about 17.5 years (70 ÷ 4 = 17.5). Investing in equities with 8% returns can counter this erosion, growing wealth and preserving its real value.

Application Tip

Choose investments with returns above inflation, such as diversified stock funds. Regularly assess your portfolio to ensure it outpaces rising costs, protecting long-term purchasing power.

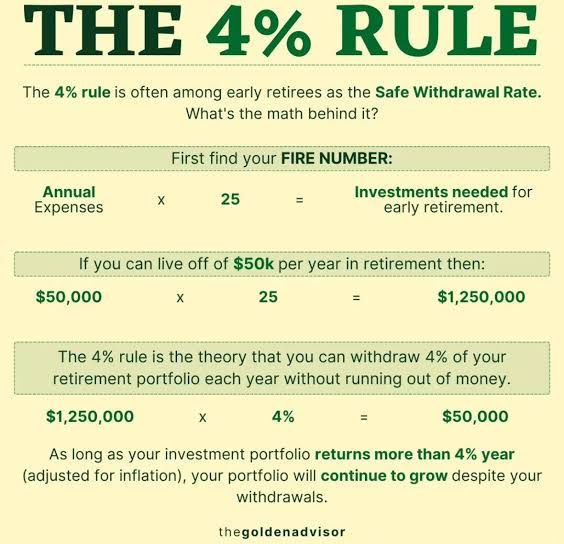

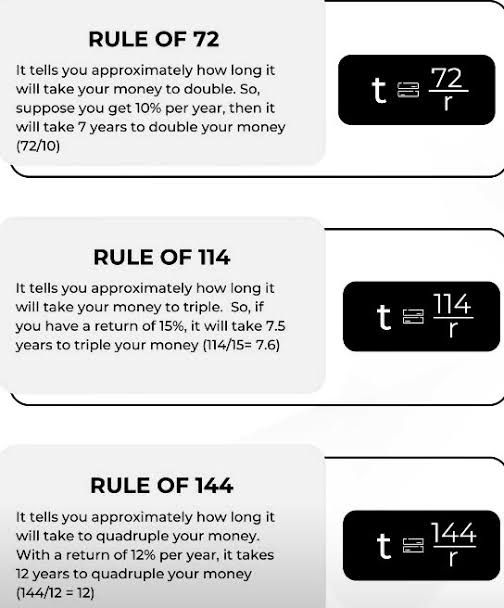

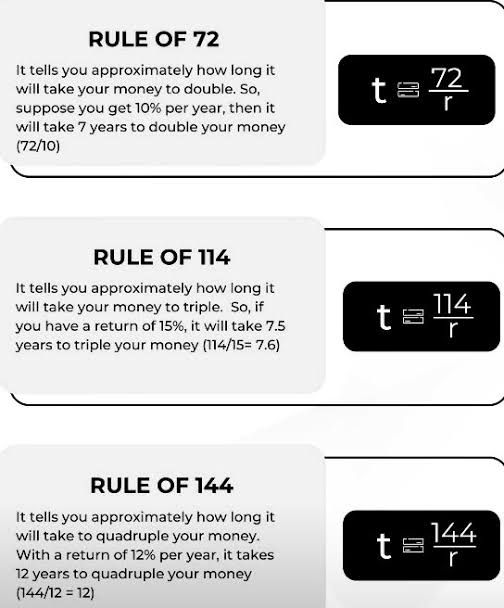

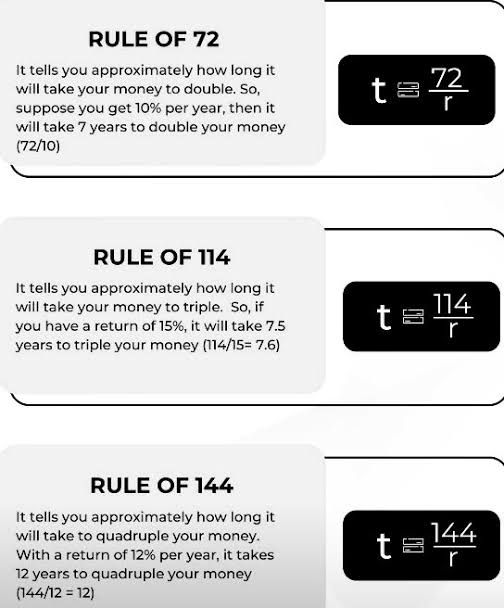

3. Rule of 144

Description

The Rule of 144 estimates the time needed for an investment to quadruple, calculated by dividing 144 by the annual rate of return. This rule showcases the exponential power of compounding, ideal for long-term goals like retirement or legacy planning. It encourages investors to prioritize consistent, high-return assets like equities to achieve significant growth over decades. By emphasizing patience and discipline, the Rule of 144 inspires strategic planning, helping investors align their portfolios with ambitious financial objectives and reinforcing the importance of long-term commitment to wealth-building success.

Example

With an 8% annual return, $10,000 quadruples to $40,000 in approximately 18 years (144 ÷ 8 = 18). Investing in a diversified equity fund can achieve this growth, supporting goals like funding a child’s education or retirement.

Application Tip

Focus on long-term, growth-oriented investments like index funds. Reinvest dividends and avoid early withdrawals to maximize compounding and reach quadrupling milestones.

2. Rule of 114

Description

The Rule of 114 calculates how long it takes for an investment to triple, by dividing 114 by the annual rate of return. This rule highlights the potential of compound interest for significant financial milestones, such as buying a home or funding retirement. It encourages early investing and selecting assets with strong growth potential, like mutual funds or stocks. By providing a clear timeline for tripling wealth, the rule fosters discipline and strategic planning, ensuring portfolios align with long-term financial security and wealth-building goals, making it a powerful tool for investors.

Example

At a 6% annual return, $10,000 triples to $30,000 in about 19 years (114 ÷ 6 = 19). A balanced mutual fund can support this growth, ideal for goals like funding a major purchase or education.

Application Tip

Start investing early in growth assets like equity funds. Stay consistent and avoid premature withdrawals to maximize the tripling effect and achieve financial goals.

1. Rule of 72

Description

The Rule of 72 is a simple yet powerful tool for estimating how long it takes an investment to double, calculated by dividing 72 by the annual rate of return. This rule illustrates the magic of compound interest, showing how even modest returns can lead to substantial wealth over time. It’s an accessible way to compare investment options, guiding decisions on where to allocate funds for maximum growth. By emphasizing early investing and high-return assets, the Rule of 72 is a cornerstone of smart investing, driving financial planning and wealth-building success.

Example

Investing $10,000 at an 8% annual return doubles to $20,000 in about 9 years (72 ÷ 8 = 9). A diversified stock portfolio or mutual fund can achieve this, supporting medium-term goals like buying a car or a home down payment.

Application Tip

Use the Rule of 72 to evaluate investment options. Prioritize assets with higher returns, like equities, but balance with risk management strategies to ensure steady, sustainable growth.